As marketer’s we constantly make educated guesses about our target audience, from what motivates them to purchase, to what they’re interested in, to their life and family stage. But the fact is, those assumptions can bias how we go about conducting research.

A good market researcher will try to challenge assumptions or a hypothesis; however, it’s not uncommon for us to want to prove our assumptions correct and search out the information that supports it…cue confirmation bias.

Many researchers will conduct surveys to gather the insights they need to fuel future product development, messaging, pricing, and more. Because surveys are a critical piece of any market research program, it is critical that you conduct research in a way that will eliminate bias in order to capture the most accurate and informative responses. Additionally, having the right tools in place can allow you to expand insights beyond just survey responses to gain a more holistic view of your panelists.

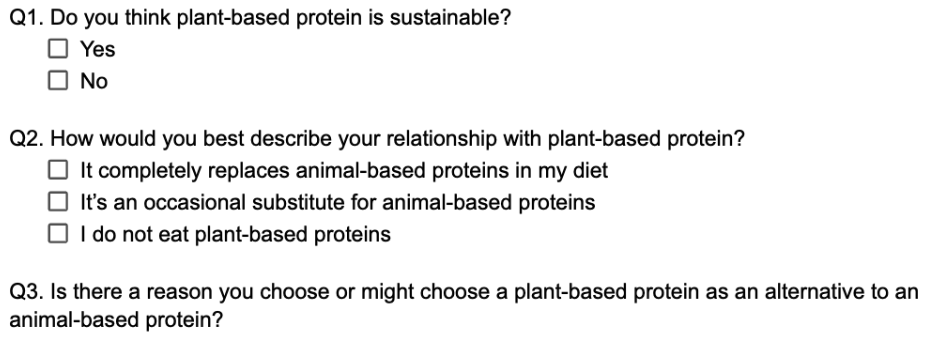

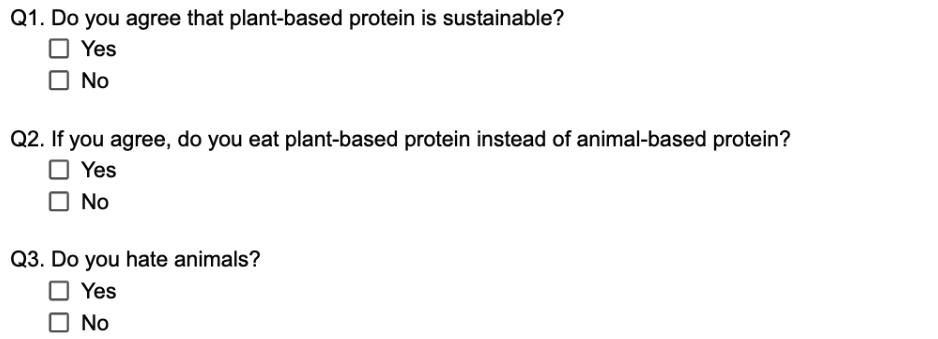

For fun, let’s look at just how easily a brief three question survey conducted by a plant-based protein company can turn from objective to bias:

Objective survey questions

Biased Survey

If we take a look at the difference between the objective versus biased survey, we can automatically see the researcher is trying to prove some kind of assumption. How survey questions are worded can change the way someone responds. For example, in the biased survey, someone might change their responses for Q1 & 2 if Q3 makes them uncomfortable

Social audience insights can help decrease confirmation bias

If you’re a good market researcher, you won’t rely on survey responses alone. You may look to both first and third-party data sources to glean any additional information you can about your audience. One source of data that is gaining momentum is social data. With over 4.5 billion active social users spending on average 2+ hours per day on social media, it’s a no-brainer that social is becoming a source for rich audience data. Marketers have the opportunity to use social data to view an audiences’ self-declared interests, passions, personality traits, brand affinities, preferred media channels and more. The key is to harness this information to challenge our assumptions, not to support them.

Unlike popular social listening tools that provide information on trending social topics, social audience insights provide a 360-view of an individual based on their social behavior and online relationships that can be mapped to offline data sources. Social audience insights allow marketers and researchers the ability to:

Create an audience that mirrors their respondents, allowing them to see if survey responses align or differ

Looking back at our plant-based protein survey above, the respondent profile is made up of 25-35 year olds living in California with careers in health and wellness. The plant-based protein company can create a similar audience at scale in a social audience insights platform. This allows them to quickly challenge any preconceived notions or survey responses by examining and comparing their data with the sentiments of those in the control group.

Upload a list of respondent profiles to a social audience insights platform and view how responses compare to their own self-declared interests on social

Taking from the same example of 25-35 year old respondents, the plant-based protein company can directly upload their list of respondents to a social audience insights platform to view if survey responses align or differ with respondent self-declared interests, passions, and affinities across social media. This helps to ensure that responses accurately represent an individual’s sentiments toward a specific topic.

Append additional insights that couldn’t be collected in the initial survey outreach

After the survey is complete, the plant-based protein company can use a social audience insights tool to append additional information on their respondents that a CRM wouldn’t include, like personality traits, influencers they trust, and media channels they frequent.

Social audience insights can be used to challenge assumptions and survey responses, but it can also help marketers to better understand their audience as a whole. Unfortunately, confirmation bias is by no means the only version of bias that can plague our research. There are several forms of bias out there, but there are ways to overcome them. A great rule of thumb is to not conduct research in a silo. Including others in your research initiatives can help filter out bias with different approaches.

How social data can further support your market research initiatives

While we’ve mainly focused on how social audience insights can help decrease bias, there are several benefits to leveraging this rich dataset in your market research programs. Here are just a few to name:

- Append social data to any existing or future panel for a 360-view of your audience

- Target even the most niche markets, including B2B, easily and at scale for survey deployment

- Conduct a comprehensive analysis on your competitor’s audience

Ready to advance your market research program with social audience insights? Let’s chat.